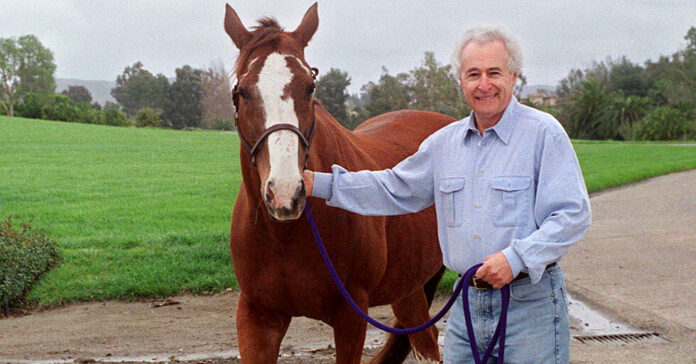

Martin J. Wygod, a Wall Street whiz who graduated from walking horses after races to owning and breeding championship thoroughbreds when he made millions from investing in online companies that sold pharmaceuticals by mail and pruned medical paperwork, died on April 12 in San Diego. He was 84.

His daughter, Emily Bushnell, said he died in a hospital from complications of lung disease.

Raised near two racetracks in suburban New York and mentored by a software pioneer, an investor and a gambler, Mr. Wygod was said to have been the youngest managing partner of a New York Stock Exchange brokerage in the 1960s.

He became a millionaire before he was 30, and in 1993 he sold Medco Containment Services to Merck for $6 billion after building it into the nation’s largest mail-order prescription drug company and benefit manager in less than a decade. The sale netted Mr. Wygod $250 million.

“The name of the game in the future is going to be information,” Jan Buck, chairman of Princeton Group International, a pharmaceutical industry consulting firm, commented on the sale to The New York Times in 1994. “Marty Wygod made $6 billion for himself because he developed a data base.”

Mr. Wygod then became the chairman of WebMD, a leader in online health information services, which he sold in 2017 for a reported $2.8 billion.

He married Pamela Suthern in 1980, and in 1995 they moved from New Jersey to River Edge Farm, a 110-acre spread in Buellton, Calif., where they raised fillies and colts to become top racehorses.

Ranked as California’s leading thoroughbred breeders in 2006, 2007 and 2008, the couple, both with and without partners, bred 124 stakes winners, according to BloodHorse magazine. They moved their breeding business to Kentucky in 2010.

Martin Joshua Wygod was born on Feb. 1, 1940, in Manhattan to Max Wygod, an accountant and haberdasher who had immigrated from Poland, and Rose (Greenwald) Wygod.

His affection for horses began when he was a student at Lawrence High School in suburban Nassau County, N.Y., where he befriended Bobby Frankel, who would become a Hall of Fame trainer. As a teenager, Martin hung out with classmates at Aqueduct and Belmont Park, where he walked horses to cool them down after workouts and races.

After graduating in 1961 from New York University, where his daughter said he studied Hinduism and Buddhism, Mr. Wygod began his Wall Street career with a $20,000 starter gift from his mother (the equivalent of a little more than $200,000 today).

He told The Times in 2000 that his mentors were Fletcher Jones, who pioneered the commercialization of computer software and initiated Mr. Wygod into the technology business; Fred Carr, an investment manager; and Manny Kalish, a gambler who handicapped races for New York’s tabloid newspapers and tutored Mr. Wygod on picking winners.

Mr. Wygod assisted Mr. Jones, a founder of Computer Sciences Corporation, in taking the company public. That offering helped grow Mr. Wygod’s $20,000 in seed money into about $50 million by the 1980s.

In 1965, Mr. Jones gave Mr. Wygod two horses for his 25th birthday.

“They both won the first time out,” Mr. Wygod said in 2000. “I was hooked.”

His stable would win more than a dozen major races over the years.

When he was 23, Mr. Wygod started his own brokerage firm; he sold it three years later for $10 million. The next year, he and two other investors, Bernie Marden and Albert Weiss, purchased a controlling interest in Glasrock Medical Services, which produced devices for the health care industry.

By 1982, by selling most of his interest in Glasrock and another company, he had parlayed his original $2 million investment into $125 million.

Mr. Carr had been an early backer of Medco. Michael Milken, another earlier investor in Mr. Wygod’s ventures, recalled to The Times in 2000 that an impetus for Medco was a complaint from Lee Iacocca, then the chairman of Chrysler, that prescription drugs for auto workers were costing the company a small fortune. Medco negotiated discounts and incentives for employees who bought lower-priced generic drugs.

“It was one of the great creations of a business, really from scratch,” Mr. Milken said. He added, “Anything that Marty does, I would invest in, except the horses.”

Actually, the horses were no exception. The racing operation run by the Wygods recorded career purse earnings of more than $21 million, including $2.8 million in their best year, 2009.

In addition to his wife and his daughter, Mr. Wygod is survived by their son, Max; a stepson, Adam Yellin; his sister, Marian; and three grandchildren.

His daughter is an equestrian to whom, along with the bloodstock consultant Ric Waldman, Mr. Wygod gave his 3-year-old colt Resilience.

Resilience could score one more notch in Mr. Wygod’s legacy. By winning the Wood Memorial on April 6 at the Aqueduct Racetrack in Queens, the horse earned a berth in the 150th Kentucky Derby, to be held on May 4.