San Diego’s inflation rate has fallen to one of its lowest levels in three years.

Inflation was 3.2 percent in San Diego County in May, down from 3.6 percent in March, said data released this week by the U.S. Bureau of Labor Statistics’ Consumer Price Index. It was the region’s lowest inflation rate since January 2021.

San Diego’s inflation figure mirrors national trends of slowed price gains. The national inflation rate was 3.3 percent in May, seen by analysts as a positive for the economy and a reason for the Federal Reserve not to raise rates.

San Diegans are unlikely to feel a change because of three years of increases, said Alan Gin, economist at the University of San Diego. Also, the current rate is still higher than the 2 percent inflation standard favored by economists.

“It’s still above” the 2 percent target, Gin said. “We’d like to see it come down more but things, at least, seem to be going in the right direction.”

Inflation hit a high point in San Diego County of 8.2 percent in 2022. Gin said it’s important to note prices are still much higher than they were before 2020 and local wages have likely not kept up pace.

“The increases we’ve had over the last few years have taken its toll,” he said. “It’s led to a much higher cost of living for everyone in San Diego.”

From March to May, San Diegans saw some things drop in price — a fairly rare occurrence over the past three years.

Household energy costs, including electricity and gas, were down 4 percent. Recreation costs, for things like gym memberships, were down 2.1 percent. Durable goods, such as electronics and appliances, were down 1.1 percent.

Here’s why your wallet probably didn’t notice: Motor fuel across San Diego County was up 4.6 percent; dairy costs rose 4.9 percent; cereals and bakery products were up 5 percent; and private transportation, which includes car insurance, increased 2.8 percent.

Of the 12 metro areas the bureau released data for this week, San Diego had the eighth highest overall inflation with the 3.2 percent rate. That’s also a rare occurrence, as San Diego typically shows up in the top three highest inflation rates, before, during and after the pandemic.

Urban Hawaii had the highest inflation rate at 5.2 percent. It was followed by Dallas-Fort Worth at 5 percent and Boston and Riverside, both at 4 percent.

The lowest was Tampa at 1.8 percent. It was followed by Denver and Minneapolis, both at 2.6 percent.

When volatile food and energy costs are removed from the overall inflation rate, called core inflation, San Diego County had a 3.1 percent annual rise, a big improvement from 5 percent to start the year.

On an annual basis, these are the areas where prices changed in San Diego County:

- Motor fuel: The price for unleaded regular was up 7.8 percent; unleaded midgrade, up 7.7 percent; and up 7.4 percent for unleaded premium.

- Food: Cereals and bakery products were up 7.9 percent; dairy, up 3.3 percent; fruits and vegetables, down 0.9 percent; and meats, poultry, fish, and eggs were up 7.5 percent.

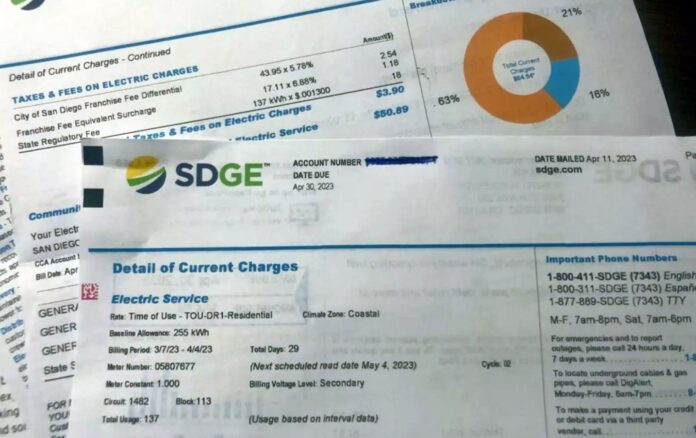

- Household energy: Electricity costs were down 12.4 percent, and utility (piped) gas service was down 10.6 percent.

- Shelter, including rent and owners’ equivalent of rent, was up 5.2 percent.

- Transportation costs, which include automobile maintenance, vehicle parts and car insurance, were up 3.8 percent. Used car and truck prices were down 8.8 percent.

- Apparel: Down 3.7 percent

- Medical care: Up 0.9 percent

Nationally, inflation was highest in the Northeast at 3.9 percent. It was followed by the West at 3.3 percent, the South at 3.2 percent, and the Midwest at 2.7 percent.

* * *

Inflation increases by metro areaAnnual, as of May 2024

Urban Hawaii: 5.2 percentDallas-Fort Worth-Arlington, TX: 5 percentBoston-Cambridge-Newton, MA-NH: 4 percentRiverside-San Bernardino-Ontario, CA: 4 percentLos Angeles-Long Beach-Anaheim, CA: 3.9 percentNew York-Newark-Jersey City, NY-NJ-PA: 3.9 percentWashington-Arlington-Alexandria, DC-VA-MD-WV: 3.3 percentSan Diego-Carlsbad, CA: 3.2 percentChicago-Naperville-Elgin, IL-IN-WI: 3.1 percentDenver-Aurora-Lakewood, CO: 2.6 percentMinneapolis-St.Paul-Bloomington, MN-WI: 2.6 percentTampa-St. Petersburg-Clearwater, FL: 1.8 percentSource: U.S. Bureau of Labor Statistics’ Consumer Price Index