AI chipmaker Nvidia surged past Apple and Microsoft to become the most valuable company in the world – the latest milestone as Wall Street investors chase the booming artificial-intelligence sector.

Shares of California-based Nvidia, whose chips are in hot demand by industry leaders ranging from Microsoft-backed OpenAI to billionaire Elon Musk’s Tesla and xAI, rose more than 3% in midday trading on Tuesday. Nvidia’s stock has swelled by more than 180% since the start of the year.

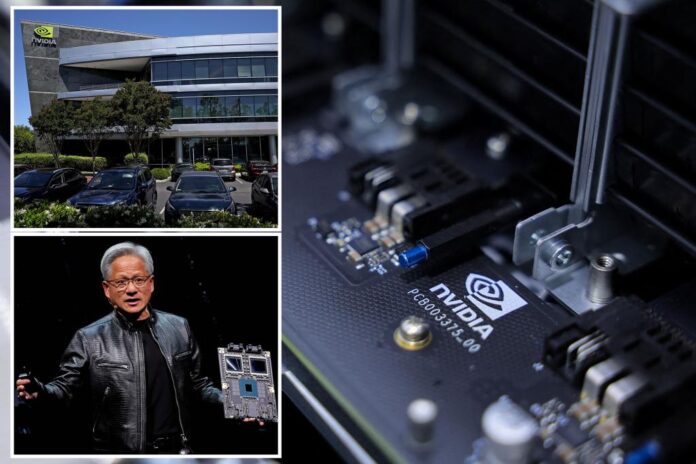

The latest uptick pushed the market cap of Nvidia — whose CEO Jensen Huang has become known for his trademark leather motorcycle jackets — to a whopping $3.33 trillion.

Microsoft fell to second place with a valuation of $3.32 trillion, followed by Apple at $3.28 trillion.

Microsoft’s stock was flat. Apple shares fell more than 1%.

Huang, who also co-founded Nvidia, has been one of the chief beneficiaries from the stock’s astronomical climb. He currently ranks as the world’s 12th richest person with a personal net worth estimated at $115 billion, according to the Bloomberg Billionaires Index.

Long known as a maker of high-end graphics cards for PC gamers, Nvidia has emerged in recent years as the key supplier for firms racing to develop advanced AI.

The firm controls roughly 80% of the market for the computer chips used to power AI data centers, according to CNBC.

In blockbuster first-quarter earnings results last month, Nvidia revealed revenue for its data center segment rose to $22.6 billion – a stunning increase of 427% compared to the same period one year ago.

Nvidia’s rise has drawn the attention of federal antitrust regulators.

The Justice Department has reportedly launched a probe into the chipmaking company’s business and whether it has violated competition laws.

In an interview with the FT, DOJ antitrust chief Jonathan Kanter noted that advanced chips have become a “scarce resource” and signaled his team was examining the process by which chipmakers decide which companies receive the critical products.

Microsoft and Apple have each made their own forays into the AI race. Microsoft has poured $13 billion into OpenAI — a deal which itself is under regulatory scrutiny — while Apple recently announced a suite of AI features will debut in its products this fall.

Apple also has a partnership with OpenAI.

Despite their astronomical valuations, some analysts say the tech firms are still poised for growth.

“We believe over the next year the race to $4 Trillion Market Cap in Tech will be front and center between Nvidia, Apple, and Microsoft,” Wedbush analyst Dan Ives said in a note to clients. “Nvidia’s GPU chips are in essence the new gold or oil in the tech sector as more enterprises and consumers quickly head down this path with the 4th Industrial Revolution well underway.”