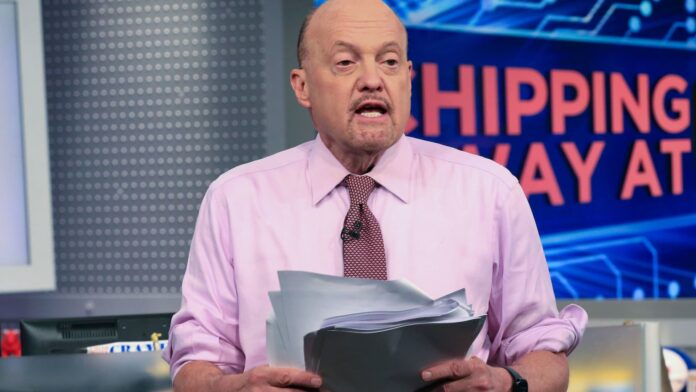

As the major averages declined Wednesday, failing to recover fully from the brutal sell-off on Monday, CNBC’s Jim Cramer explained the current dynamics and attitudes at play on Wall Street. He used Disney‘s post-earnings stock performance to explain how investors want rate cuts but are also concerned by a lack of consumer spending.

“You can’t hope for rate cuts from the Federal Reserve and also expect zero weakness in any part of the economy that impacts your portfolio,” he said. “Wall Street wants to have it both ways, but we’ll never get those rate cuts until the Fed sees cash-strapped consumers rebelling against higher prices, forcing companies to roll them back to pre-Covid levels.”

Disney topped Wall Street’s expectations for earnings and revenue, with management touting its streaming services’ performance and profitability. However, the media giant also indicated its theme parks business was affected by inflation and weaker consumer demand.

Finance chief Hugh Johnston said the business saw a “slight moderation in demand,” adding that it was “a bit of a slowdown that’s being more than offset by the entertainment business.”

By Wednesday’s close, Disney shares had declined 4.5%.

To Cramer, this situation is emblematic of the issues many other companies face as consumers become more selective in their spending. Still, he’s confident the Fed will cut rates, which could take the pressure off consumers.

The company’s parks haven’t lost their relevance, he argued. They’re just more expensive than other leisure options.

Cramer noted that Disney may have the ability to reduce prices, because of the success of other parts of its business, adding that even if the Fed cuts rates, consumers may still demand lower prices.

“The Fed can rejoice and stretch the time before it cuts rates until it sees the Disneys of the world cut prices en masse, or it can anticipate what’s going to happen and move now,” he said.

Disney did not respond immediately to a request for comment.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Disney

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? [email protected]