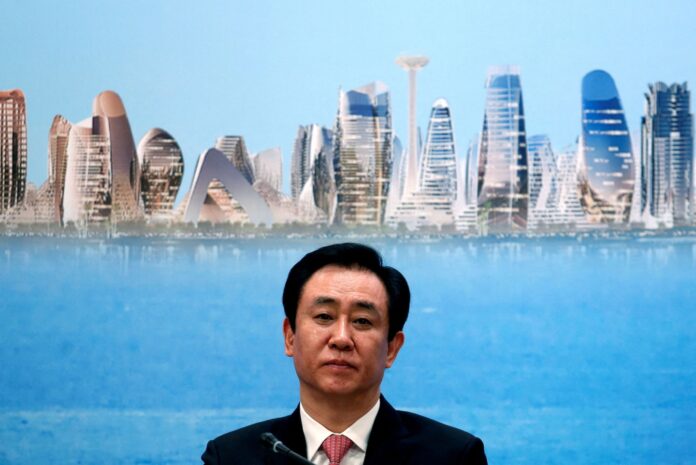

Then, on Thursday, the group and two of its major subsidiaries suspended trading after Bloomberg reported that its billionaire chairman, Xu Jiayin, was being held under “residential surveillance” by Chinese police. Xu is also called Hui Ka Yan, the Cantonese pronunciation of his name.

The fall from grace of Xu and his company — he was by some estimates China’s richest businessperson in 2017 — tracks the rapidly declining health of the Chinese property sector, which accounts for nearly a quarter of economic growth in the world’s second-largest economy.

The spate of bad news suggests that China’s efforts to achieve a “controlled demolition” of its most indebted company might be spiraling out of control — and toward liquidation for the heavily indebted developer.

Recent events have shown that “Evergrande isn’t in the good graces of the authorities,” said Janz Chiang, an analyst at Trivium China, a Beijing-based research firm.

Aside from Xu, other sitting and former executives of China Evergrande Group and its subsidiaries are being investigated by Chinese authorities for potentially breaking rules over the use of bank deposits, respected Chinese media outlet Caixin reported this week.

The investigation makes it difficult to reach a restructuring deal. “Some creditors have already announced their intention to join a winding-up petition if Evergrande fails to come up with a new plan, which seems difficult given ongoing troubles,” Chiang said.

A messy end to Evergrande’s saga would deal a blow to already shaky confidence in the ability of Xi Jinping, China’s powerful leader, to coax the slowing economy out of a post-pandemic malaise.

While many of the problems dampening growth predate Xi — Chinese property developers have been overbuilding and over-borrowing for decades — some close observers of China’s political economy blame the downturn on Xi’s attempt to pursue major, top-down overhauls too quickly on too many fronts.

A no-deal outcome could shatter confidence of a recovery in the embattled sector and reverse optimism among other developers that are fighting to avoid a similar fate.

China’s largest property developer by sales, Country Garden, which has also flirted with default, reached an agreement with creditors on Tuesday to delay its repayments on domestic loans, Reuters reported.

In an effort to end the slump, cities across China are trying to revive property sales by making it easier for nonresidents to buy homes as well as cutting down payment requirements and improving mortgage rates.

Across the broader economy, too, there were signs of recovery in August, as sales of goods picked up and exports stabilized. Many analysts are watching China’s upcoming week-long public National Day holiday to see whether confidence is returning to the scores of Chinese consumers who remain reluctant to spend.

But many analysts consider the possibility of the property bubble bursting the biggest threat to economic recovery.

“[The property sector] is the biggest immediate problem that can worsen structural issues, such as confidence,” said Gary Ng, senior analyst at Natixis, a Hong-Kong based investment firm.

Evergrande is “a symptom of the ongoing problems in the real estate sector, which may drag down China’s economic growth in the future,” Ng said.