Ryan Salame, a former top lieutenant of FTX founder Sam Bankman-Fried, has been sentenced to 90 months, or seven and a half years, in prison, followed by three years of supervised release. Salame has also been ordered to pay more than $6 million in forfeiture and more than $5 million in restitution.

The sentence is a heavier penalty than the five to seven years that prosecutors had suggested and well beyond the 18 months that Salame’s defense team had requested.

In September, Salame pleaded guilty to conspiracy to make unlawful political contributions, defraud the Federal Election Commission, and conspiracy to operate an unlicensed money-transmitting business.

Judge Lewis Kaplan sentenced Sam Bankman-Fried to 25 years in prison in March.

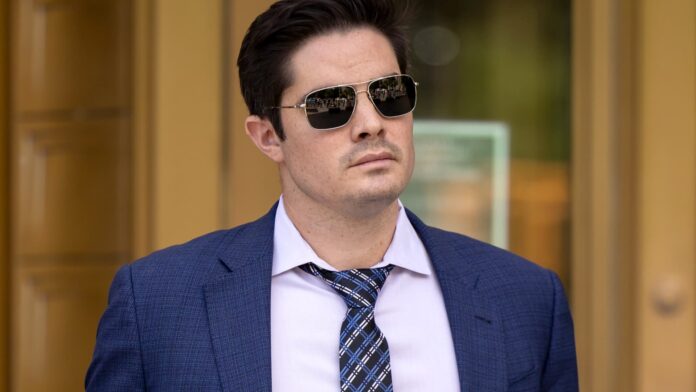

Ryan Salame, former co-chief executive officer of FTX Digital Markets Ltd., exits federal court in New York, US, on Tuesday, May 28, 2024.

Yuki Iwamura | Bloomberg | Getty Images

In 2021, Salame transitioned from a high-ranking post at Bankman-Fried’s crypto hedge fund, Alameda Research, to co-CEO of FTX’s Bahamian subsidiary, FTX Digital Markets. Salame spent millions on real estate and campaign donations during his tenure.

One estimate by Bahamian lawyers claims that Bankman-Fried and Salame spent $256.3 million to buy and maintain 35 properties across New Providence — real estate that Bahamian regulators wanted to retrieve in FTX’s U.S. bankruptcy protection proceedings. Meanwhile, data from the Federal Election Commission shows that Salame gave more than $24 million to Republican candidates and causes in the 2022 election cycle.

Days before FTX filed for bankruptcy in 2022, Salame went to Bahamian authorities to tell them that the Bankman-Fried may have committed fraud by sending customer money from the crypto exchange to his other firm, Alameda Research. According to a criminal filing, Salame disclosed “possible mishandling of clients’ assets” by Bankman-Fried.

It was one of the first public acknowledgments of an insider turning on Bankman-Fried, who was found guilty of stealing more than $8 billion worth of customer cash they believed was being safely stored on the exchange.

Ryan Salame, the former co-chief executive of FTX Digital Markets, exits the Federal Court after he pleaded guilty to two charges including conspiring to make unlawful U.S. political contributions, in New York City, Sept. 7, 2023.

Brendan McDermid | Reuters

Since then, however, several other insiders, including Alameda’s former CEO and SBF’s ex-girlfriend, Caroline Ellison, FTX co-founder Gary Wang, and FTX’s ex-engineering head Nishad Singh, all gave testimony for the prosecution that ultimately contributed to his guilty verdict in November. Salame did not take the stand during Bankman-Fried’s trial.

In a statement, U.S. attorney Damian Williams said Tuesday’s sentence underscored “the substantial consequences for such offenses.”

“Salame’s involvement in two serious federal crimes undermined public trust in American elections and the integrity of the financial system,” Williams added.

Former state and federal prosecutor Mark Bini told CNBC the sentence underscored that the judge viewed the fraud at FTX, including the multi-million dollar campaign finance scheme in which Salame was directly involved, as extremely serious.

“While Salame’s counsel sought to argue that his production of documents to the Government showed his cooperation and contrition, it’s clear that Judge Kaplan did not view it that way,” said Bini.

Salame is the first of SBF’s executive team to be sentenced since the exchange filed for bankruptcy in Nov. 2022.

— CNBC’s Dan Mangan contributed to this report.