Receive free Equities updates

We’ll send you a myFT Daily Digest email rounding up the latest Equities news every morning.

Trend-following hedge funds have piled into global equities as market volatility has fallen and stocks climb on investors’ hopes that interest rate rises are close to their peak.

Commodity trading advisers — hedge funds that rely on pattern-detecting algorithms and statistical models to direct trading across markets — have in recent weeks increased their exposure to equities to the highest level since before the pandemic, according to Deutsche Bank.

CTAs managing hundreds of billions of dollars in assets now have net long futures positions on Wall Street’s S&P 500, Europe’s Euro Stoxx 50, London’s FTSE 100 and Japan’s Nikkei 225, among other indices, Deutsche said.

The broad sell-off in stock and fixed income markets last year powered the computer-powered quantitative investment industry to its best annual returns in more than two decades. However, it has largely missed out on this year’s unexpected stock market gains.

“Last year we had a trend downwards for bonds and equities and that’s the kind of environment where momentum-following CTAs do really well. This year we’ve had more gyrations, especially on the bond side,” said Parag Thatte, a strategist at Deutsche Bank.

Société Générale’s CTA index — which measures the performance of 20 major funds, including those managed by Man Group, Lynx Asset Management and Pimco — rose almost 20 per cent last year as equity markets slumped but has shed 2.2 per cent since January even though stocks have rebounded, Refinitiv data shows.

“In May and June the [US] equity rally was very much a short covering exercise,” said Huw Roberts, head of analytics at research group Quant Insight, describing how big investors bought back stocks they had been betting against to limit their losses. “The July rally was all about new [investments] going on.”

CTAs have slowly raised their equity holdings — as well as those in gold, copper and oil — as their aggregate exposure to bonds and currencies has declined.

Those shifts have come as the Vix volatility index, which measures expected volatility on the blue-chip S&P 500, has dropped to its lowest level since early 2020, despite the shadows of high inflation, economic recession and the uncertainty over when interest rates will begin to fall.

“For CTAs, both volatility and trend signals matter,” said Thatte. “As volatility has come down, CTAs have upped their equity positioning, and markets have gone up at the same time so they’ve gone from short equities to long.”

That means that some CTAs would dump equities, exacerbating a wider sell-off, if volatility were to suddenly shoot higher, however.

“Summer is often when there’s a crisis,” Roberts said. “Maybe it’s because desks are thinly manned, so liquidity is poor. But you need a catalyst for a volatility event. Anything that ruins the idea that we’ve hit peak rates and that cuts are coming would probably do the trick.”

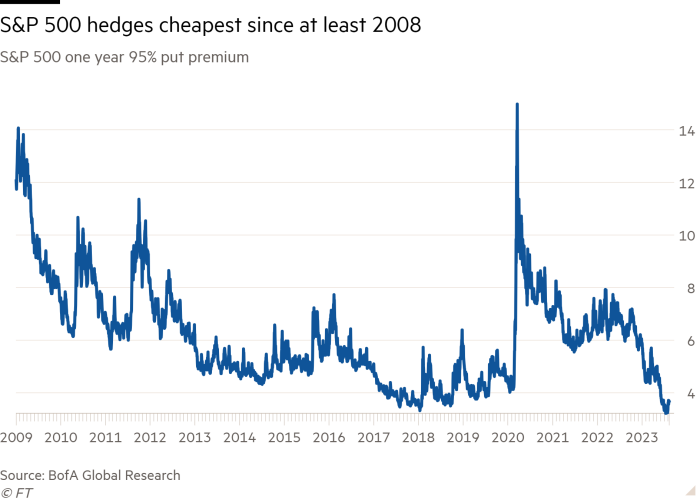

Markets have yet to factor in such risks. “Since our data began in 2008, it has never cost less to protect against an S&P 500 drawdown in the next 12 months,” Bank of America analysts said in late July.