Not everyone will be happy when the Federal Reserve begins lowering interest rates after it declares victory over inflation.

Remember, there is a large but low-profile flock of folks with money who like to profit in a very old-fashioned way – savings accounts.

For almost two years, these investors enjoyed the highest rates on these zero-risk bets since the turn of the century. But now it seems the “bull market” for no-brainer savings may be coming to an end.

So for fans of these less-than-sexy investments, it may be time to get busy locking in some longer-term deals with certificates of deposit. And I wish I could end this column right here and tell you to simply go to your neighborhood banking institution and load up on attractive CD rates.

But unfortunately, finding decent deals is not very simple. So let me walk you through the CD maze.

First a history lesson

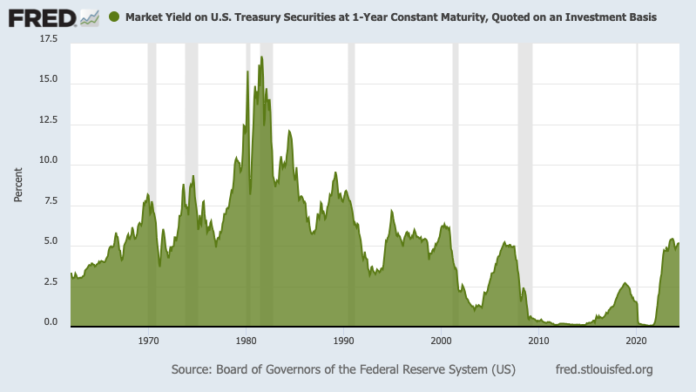

Before the Fed’s war on inflation began in 2022 with rising rates, the post-Great Recession era was painful for savers. Yields crumbled to near zilch as the Fed used cheap money to ease the financial woes. Then they repeated the tactic to soothe the pandemic’s business challenges.

Think about rates on 1-year Treasury bills – a benchmark for typical savings rates. In the last 38 years of the 20th century, 1-year yields averaged almost 7%. But they paid barely 1% on average since the global financial crisis erupted in 2008 – until 2023.

So last year’s 5% rates – the highest 1-year yields since 2000 – made savers euphoric.

What’s your stash?

First, figure out how much money you can put away for a year or more. This sum can be split into buckets by years, and you can match any savings needs to the maturity length of the CD.

Please be realistic with your liquidity needs. Most banks and credit unions – but not all – charge significant fees if you have to exit your CD early.

Where to look

If you contact your bank or credit union, it’s unlikely they have the most exciting rates.

Get online. A simple search will offer you numerous lists detailing “best” CD rates. Sadly, you’ll have to wade through a half-dozen personal finance websites to find a CD or two that stands above the pack.

Be aware that many CD rankings promote partner institutions. So highlighted rates may not be the best available. Still, institutions paying for this kind of marketing often offer decent deals.

Online friendly?

You’ll increase your odds for a worthy rate if you are willing to bank remotely.

Still, my quick survey of recent high-rate CDs found several offerings from institutions with California branches for anyone who still needs to do face-to-face business.

Another geography factor is that certain must-have rates come with geographic or other limits.

There are banks that only do business in certain states. And many credit unions have odd membership requirements, where you live being one of them.

The caveats

There also are some too-good-to-be-true offers.

First, make sure you’re getting a certificate of deposit from a federally insured institution. Some “best rate” list are sprinkled with annuities – an insurance company product that looks and feels a lot like a CD.

Also, make sure an attractive account has a fixed rate. Some institutions sell variable-rate CDs with yields that will certainly change as rates go down as forecast in the coming years.

Don’t forget to check what size deposit qualifies for a high rate.

Some deals come with high-balance requirements. And believe it or not, some “wow!” rates are good only for modest amounts. Savings above the maximums often get paid mere pennies.

But there’s a but …

Allow me to note two twists on CDs worth considering — if your head isn’t already spinning from all the details required to get what is supposedly a boring investment.

No-penalty CDs: Fixed rates for an extended term with two catches: Savers can withdraw money from the account early without penalty, but rates run slightly below similar offerings that come with early withdrawal penalties.

Still, they provide comfort to the saver who is anxious about tying up money for an extended period.

Brokered CDs: These are bought on financial markets – just like stocks and bonds. Curiously, some of the giant banks that offer next to nothing on their branch CDs will be very competitive in the broker CD world.

The “but” is that these can be confusing to acquire.

For the do-it-yourself investor, online brokerage accounts don’t make it easy to find or buy these CDs.

And if you go to a financial adviser with your stash of cash, you’ll likely get a pitch about other investments – most containing some level of risk – that you may not want to listen to.

Bottom line

Locking in two to five years of near-5% yields doesn’t make for “financial genius” bragging rights.

But CDs are great for earning extra money on your spare cash – or folks who need to know economic gyrations or political hijinx won’t dent their nest egg.

And today’s CD rates look like a bargain that will evaporate soon.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Originally Published: