Reaching net zero emissions is essential to mitigating the worst effects of climate change, but it will also take a massive investment, according to Goldman Sachs Research.

Offsetting the greenhouse gases produced by human activities by 2070 will require an investment of about $75 trillion, Goldman wrote.

To put that amount into perspective, it’s more than two-and-a-half times U.S. GDP, which hit $29.35 trillion in the third quarter.

Through the Paris Agreement, which the U.S. left in 2017 and then rejoined in 2021, leaders from nearly 200 countries agreed to help keep global average temperatures from rising more than 1.5 degrees celsius above pre-industrial levels. Yet faster-than-expected warming means global temperatures could surpass the 1.5 degree limit in the next five years, according to the World Meteorological Organization.

As the goals of the Paris Agreement seem increasingly out of reach, Goldman has updated its projections. The $75 trillion investment will help keep global average temperatures from rising 2 degrees celsius above pre-industrial levels. It previously predicted that reaching net zero emissions by 2060 would require $62 trillion of investment.

Although the estimated investment is astronomical, it could also be a major opportunity for investors looking to capitalize on the world’s transition to sustainable energies, according to Goldman.

It’s crucial to allocate money to a multi-dimensional plan that encourages not just renewable energy, but also clean hydrogen, better battery energy storage, and improved carbon capture in order to reach net zero, Goldman wrote.

While about $30 trillion should be allocated to renewable energy, Goldman sees the need for $5 trillion to be invested in improving energy storage through better batteries.

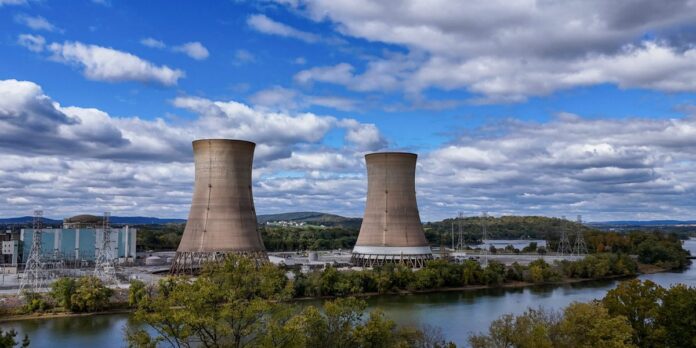

Another $9.3 trillion should be dedicated to making industrial activities more eco-friendly. This includes doubling down on carbon capture, utilization, and storage processes, which captures the carbon dioxide emitted from industrial plants to be used elsewhere or injected deep into the Earth for storage.

That’s as fossil fuels will continue to be used for decades to come. Goldman sees oil demand reaching its peak after 2029, later than the International Energy Agency currently predicts, and foresees natural gas being used as a “transition fuel” through 2050.

“Our path consistent with net zero by 2070 calls for an evolution of the de-carbonization process from one-dimensional (renewable power) to a multi-dimensional ecosystem” wrote Michele Della Vigna, Goldman Sachs Research’s head of natural resources research in Europe, the Middle East, and Africa.

Join business’s brightest minds and boldest leaders at the Fortune Global Forum, convening November 11 and 12 in New York City. Thought-provoking sessions and off-the-record discussions feature Fortune 500 CEOs, former Cabinet members and global Ambassadors, and 7x world champion Tom Brady–among many others.

See the full agenda here, or request your invitation.