When UBS agreed to buy its archrival Credit Suisse for a little over $3 billion this spring at the Swiss government’s behest, analysts and investors said that price represented a steep discount. UBS’s latest financial results reflect just how much of a steal it was.

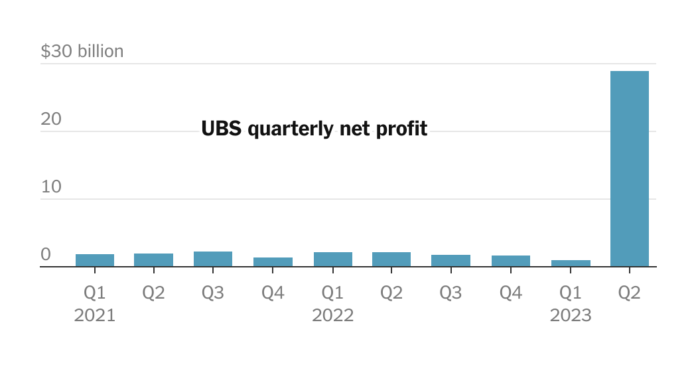

On Thursday, the bank reported a $29 billion profit in its second quarter — yes, billion with a “b” — the biggest quarterly profit in banking history.

But that paper gain belies the challenges that UBS faces as it moves to complete the largest takeover of a bank since the 2008 financial crisis. That process will include absorbing some of its onetime competitor’s domestic footprint and shuttering a large portion of its investment banking operations.

UBS’s huge profit arises from “badwill,” an accounting phenomenon where a company buys an asset for less than it is worth, leading to a noncash gain that essentially recognizes the actual value of the asset. (It’s also known as “negative goodwill.”)

UBS reported that its underlying profit for the quarter was just $1.1 billion.

A wave of bank rescue deals this year has led to pumped-up profits for acquirers. Second-quarter profit at JPMorgan Chase jumped 67 percent in large part because of its takeover of First Republic, while First Citizens enjoyed a 3,500 percent gain in profit for the first three months of the year — to $9.5 billion, from $243 million — after buying Silicon Valley Bank at a steep discount.

But UBS has more work to do before it completes its Credit Suisse acquisition, which is expected by 2026. Among its biggest tasks is consolidating its former rival’s domestic bank with its own, despite concerns that the move will undercut competition in Swiss retail banking.

Uniting the two will lead to some 3,000 job losses in the country, validating fears among politicians and voters. But on Thursday, UBS defended its decision: “Our analysis clearly shows that full integration is the best outcome for UBS, our stakeholders and the Swiss economy.”

Credit Suisse’s own results — including a pretax loss of 4.3 billion Swiss Francs ($4.9 billion) in the quarter, tied to customer withdrawals and struggles in investment banking — suggest that UBS still has big hurdles to overcome in absorbing the business.

UBS has also signaled that it will close a significant portion of Credit Suisse’s investment banking and trading operations, which helped contribute to the troubles that led to the collapse of the 167-year-old institution.

For now, UBS shareholders appear happy, especially with the badwill gain showing just how much the bank benefited from rescuing its rival. (UBS manages about $5 trillion in client assets after the deal.) Shares in the bank closed up more than 6 percent on Thursday, and now trade at their highest level since the summer of 2008.