A National Insurance cut for millions of workers is expected when Chancellor Jeremy Hunt makes his Autumn Statement on Wednesday.

However, previously announced changes to National Insurance (NI) and income tax mean millions of people will pay more tax.

What is National Insurance and how could it change?

NI is the second biggest source of money for the government, and applies across the whole of the UK.

For employees, it is similar to income tax in many ways. A fixed percentage of the money you earn is deducted from wages.

You do not pay NI on the first £12,571 you earn a year. It is then charged at 12% on earnings up to £50,271, and 2% on income above that.

Self-employed people pay 9% on profits between £12,570 and £50,270, and 2% on profits above that.

NI is not paid by people over state pension age even if they are still working.

Employers also have to pay NI contributions.

At this stage, it is not totally clear how much of a reduction Mr Hunt will reveal, although some reports suggest a 1% cut. That could cost the Treasury around £5bn.

NI payments, which were introduced in 1911, contribute to the cost of benefits, the NHS and the state pension.

What is happening to National Insurance thresholds?

The level of income at which you start paying National Insurance is called the threshold. National Insurance and income tax thresholds used to rise every year, typically in line with inflation.

But the chancellor has already said that the main National Insurance and income tax thresholds will remain frozen until April 2028.

Freezing the thresholds means that as wages rise, more people have to pay NI for the first time and will pay more in total.

What is happening to income tax thresholds?

The amount of income tax you pay also depends on thresholds – the levels of income at which people either start paying tax, or have to pay higher rates of tax.

Freezing these thresholds means that the tax-free personal allowance will remain at £12,570. Most taxpayers do not pay any tax on income below this level.

The point at which higher tax rates take effect will also not change.

This will create 3.2 million extra taxpayers by 2028, and 2.6 million more people will pay higher rates of tax. That’s according to the Office for Budget Responsibility (OBR) – which independently assesses the government’s economic plans.

The policy is expected to raise £25.5bn more a year by 2027-28 than if the thresholds had gone up in line with the CPI measure of inflation.

What is the basic rate of income tax?

You pay the basic rate of income tax on earnings between £12,571 and £50,270 a year.

The basic rate is 20%, so a fifth of the money you earn between those amounts goes to the government in income tax.

What is the higher rate of income tax?

The higher rate of income tax is 40%, and is paid on earnings between £50,271 and £125,140.

Once you earn more than £100,000 a year, you also start losing your tax-free personal allowance. This means you have to pay income tax of 40% on some of the first £12,570 of your earnings.

You lose £1 of your personal allowance for every £2 that your income goes above £100,000. So if you earn more than £125,140 a year, you no longer get any tax-free personal allowance.

What is the additional rate of income tax?

The additional rate of income tax is 45%, and is paid on all earnings above £125,140 a year.

The government says about 629,000 people pay the additional rate of income tax.

Which types of income do you pay tax on?

You pay income tax to the government on earnings from employment and profits from self-employment during the tax year, which runs from 6 April to 5 April the following year.

Income tax is also due on some benefits and pensions, the money you get from renting out property, and returns from savings and investments above certain limits.

These rules apply in England, Wales and Northern Ireland. Scotland has different tax rules to the rest of the UK.

Who pays most in income tax?

For most families in the UK, income tax is the single biggest tax they pay. You can see that in the dark green bars in the chart below.

But poorer households tend to pay a bigger share of their taxes through taxes on the money they spend such as VAT and duties, rather than the money they earn. These “indirect taxes” are shown in the blue areas in each bar.

For the poorest fifth of households, VAT is the biggest single tax paid.

How is tax different in Scotland?

Some income tax rates are different in Scotland because of powers devolved to the Scottish Parliament.

These are the Scottish income tax rates from April 2023:

- Tax-free personal allowance: £12,570 (reduced by £1 for every £2 earned above £100,000)

- Starter rate of 19%: £12,571 to £14,732

- Scottish basic rate of 20%: £14,733 to £25,688

- Intermediate rate of 21%: £25,689 to £43,662

- Higher rate of 42%: £43,663 to £125,140

- Top rate of 47%: above £125,140

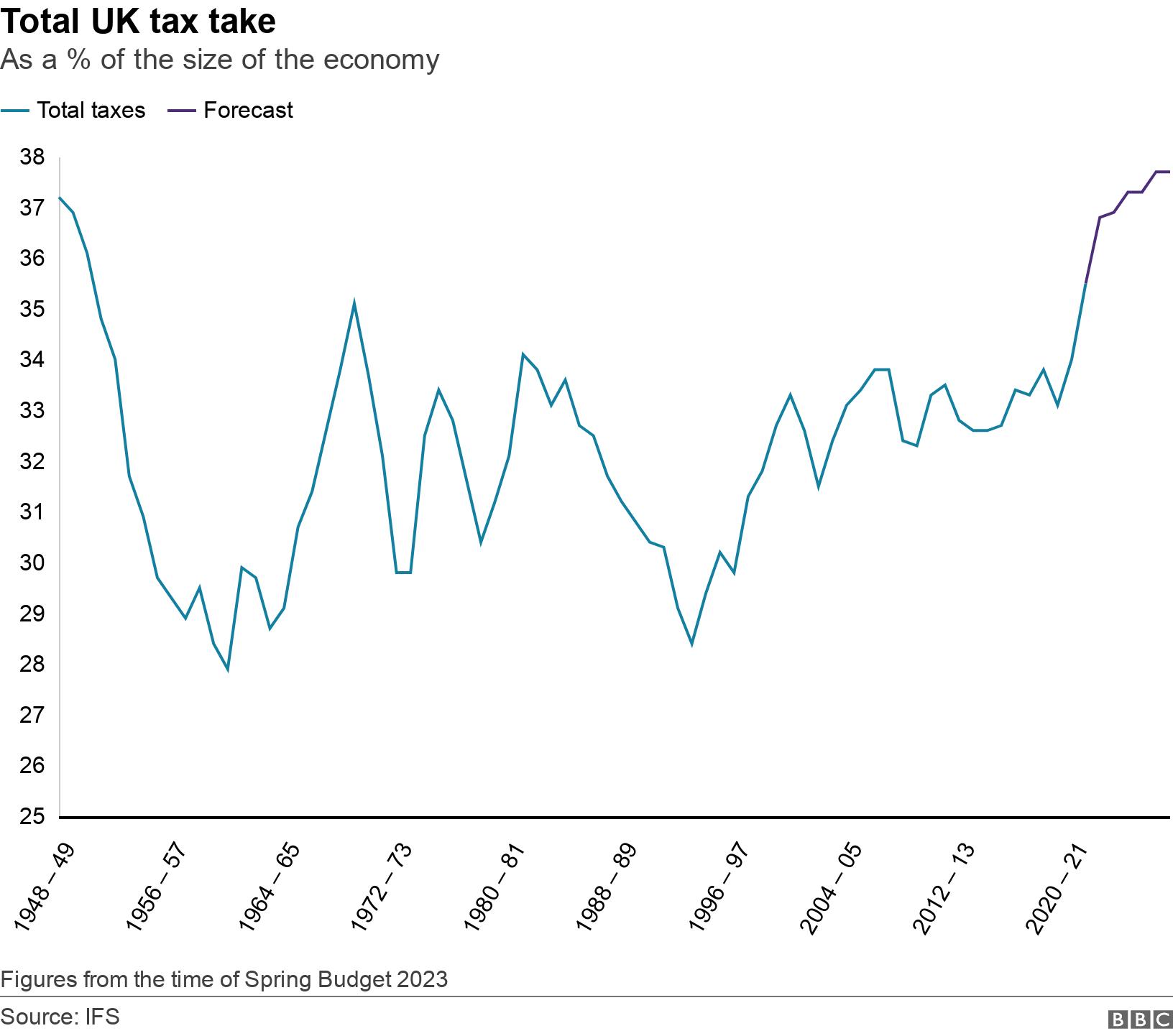

How high are UK taxes historically?

One way of measuring how high taxes are is to consider the amount of tax raised as a proportion of the size of the economy.

Under current plans, the amount of money the government takes in tax is forecast to rise to 37.7% of the size of the economy by 2027-28, up from an estimated 36.9% in 2023-2024.

By that measure, it would be the highest level of tax the UK has ever seen.

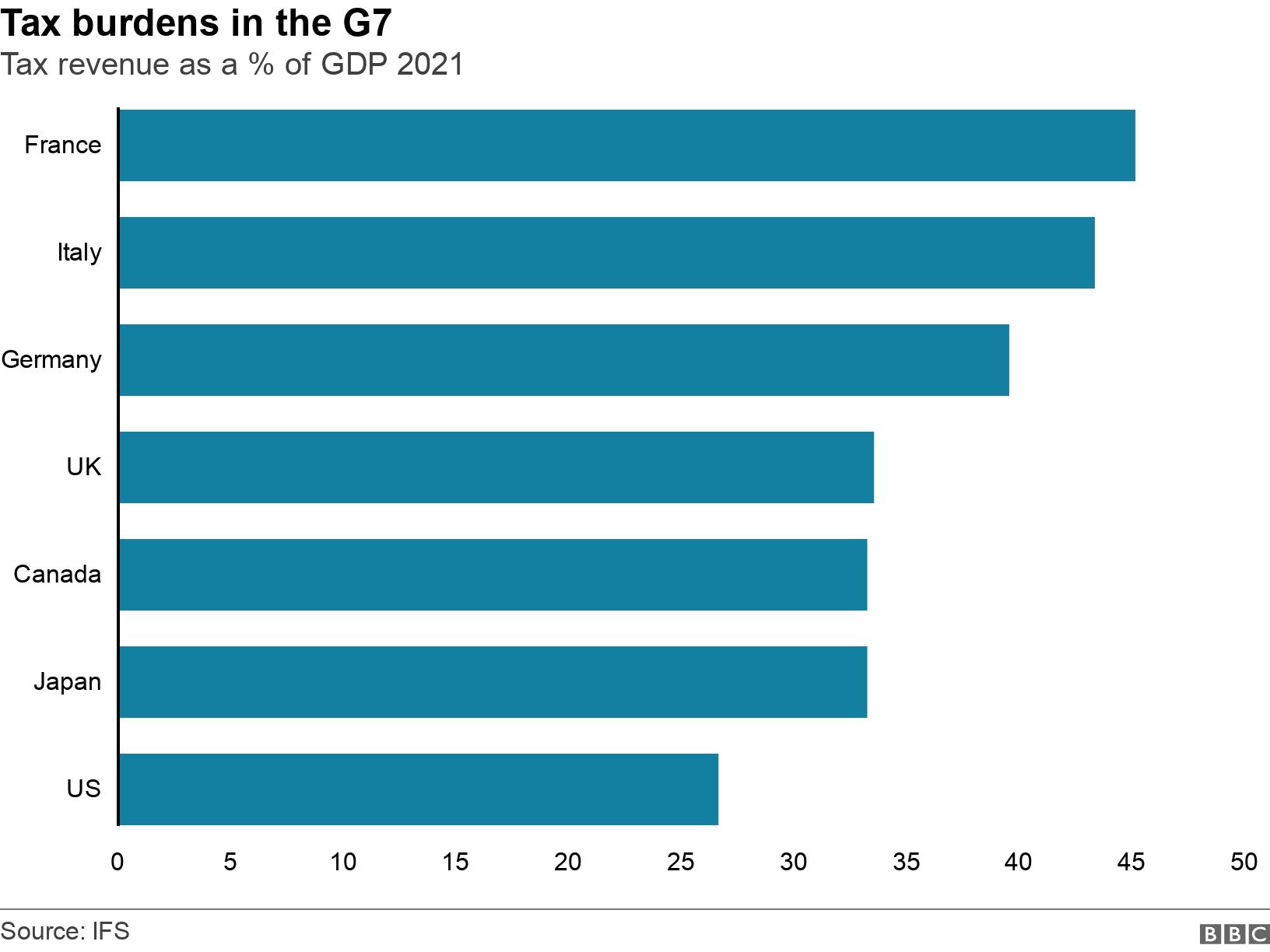

How do UK taxes compare with other countries?

If you look at the amount of tax raised as a proportion of the size of the economy in 2021 – the most recent year for which international comparisons can be made – the figure was 33.5%.

That puts the UK right in the middle of the G7 group of big economies.

France, Italy and Germany tax more, Canada, Japan and the US tax less.