Whether your holiday season comes with flight delays, a long road trip or a rare day with space on your calendar, it’s likely you’re about to have some free time.

If you’d like to use it to get a little smarter about deals and the economy — and perhaps even enjoy yourself in the process — you’re in luck: Here are our favorite books and podcasts from this year (plus one game) that will help you do just that.

An investigative reporter unpacks the crypto industry

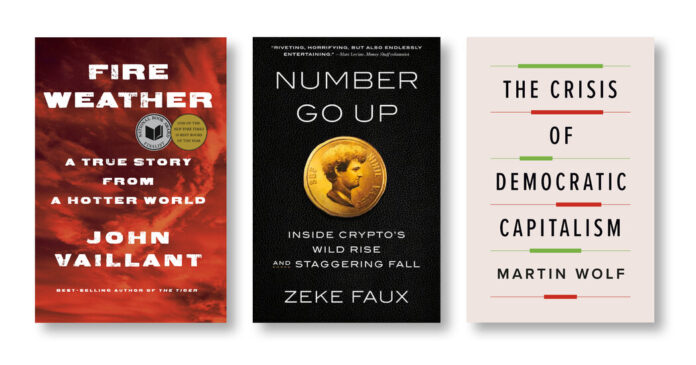

“Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall” by Zeke Faux

Cryptocurrency has its detractors, including the JPMorgan Chase chief executive, Jamie Dimon, who told a congressional hearing this month that the government should ban digital assets. But few crypto critics have been as committed to trying to understand the technology and to thoroughly exploring the industry — which has seemed at times to make money from nothing — as the Bloomberg investigative reporter Zeke Faux. In his book, “Number Go Up,” he travels around the world for two years meeting the people fueling the enthusiasm for digital tokens — and uncovering corruption, greed and exploitation along the way.

The book was released about a month before the criminal trial of Sam Bankman-Fried, the founder of the crypto exchange FTX, who was convicted of seven counts of fraud and conspiracy last month. Faux begins by admitting that he did not see through Bankman-Fried’s billionaire wunderkind facade when they met. But Faux did have his suspicions about the crypto industry and promises from digital asset enthusiasts that blockchain would democratize finance, and he met many of the people peddling these ideas. “From the beginning, I thought that crypto was pretty dumb. And it turned out to be even dumber than I imagined,” he writes.

Global trade, the online game

Tradle

Quiz time: Which country’s outbound trade was roughly $597 billion in 2021? A hint: Its top export categories were cars, refined petroleum, wine and valves.

A. Japan

B. Argentina

C. United States

D. Italy

The answer is D, Italy.

That’s according to Tradle, the Wordle-style game about world trade that has become a daily habit for economics buffs, global policy geeks and at least one DealBook editor.

Developed by the Observatory of Economic Complexity, a trade data visualization specialist, Tradle takes gamers across the globe each day. The hints could lead to a developing island economy whose chief exports are recreational boats (the Cayman Islands, for example) or to a Group of 7 giant like Canada (Spoiler: chief exports include crude oil, sawed wood and fertilizers).

Gilberto García-Vazquez, an economist whose firm is behind the game, told Marketplace this summer that Tradle’s global popularity was a big surprise. The site was attracting “close to a million visits per month,” he said, another sign that everyone likes a good game — even ones about global trade.

If Hollywood had a sports podcast

“The Town”

Who’s up in the media business and who’s down? Tinseltown’s chief industry has an image built on art and glamour, but Matt Belloni’s podcast about its inner workings treats it like sports, with an A.M. talk-radio vibe (no surprise, given its roots in The Ringer podcast network) and an informed casual approach to the subject. Belloni rose up through the Hollywood trades and is the author of Puck’s flagship newsletter, What I’m Hearing, but on the podcast he adopts an approach that welcomes in more casual followers of media news. Close watchers of the industry, however, will still appreciate the interviews with newsmakers like Ted Sarandos, a Netflix chief executive, and Mark Shapiro, president of Endeavor, on hot topics like the streaming wars, the actors’ and writers’ strikes and why superhero movies are stumbling.

A glimpse into a climate apocalypse

“Fire Weather: A True Story From a Hotter World” by John Vaillant

Wildfires were all over the news in 2023. Burning Canadian forests smothered New York in smoke, there were deadly blazes in Maui, and extreme heat caused Greece’s worst fires on record. In “Fire Weather,” the reporter John Vaillant writes about an earlier wildfire that provided a hint of what was to come.

In 2016, Fort McMurray, Alberta, was engulfed in flames, forcing 90,000 people to evacuate. The city is the center of Canada’s oil sands industry, which means it relies on the production of fossil fuels that contribute to global warming. Vaillant calls it a “bifurcated reality,” with executives acknowledging the threat posed by carbon dioxide emissions but still making money from the industry despite the damage it evidently causes.

The contradictions won’t end soon. Some of the world’s biggest energy companies signaled this year that they are doubling down on fossil fuels via a series of deals in the shale oil patch. July was the hottest month ever recorded. And the United Nations’ climate conference in United Arab Emirates — a petrostate — was the first to publicly state that the world needs to move away from fossil fuels.

We aren’t done producing and using fossil fuels, and our world is heating up. Those two trends are inevitably going to bang into each other again, and Vaillant’s book is a useful look at how that might unfold.

A warning about the geopolitical challenges threatening market democracy

“The Crisis of Democratic Capitalism” by Martin Wolf

Martin Wolf, the chief economics commentator at the Financial Times, is a believer in the marriage of liberal democracy and market economics. The combination, he argues, has created the most successful societies in history, generating prosperity and freedom.

In “The Crisis of Democratic Capitalism,” he argues that’s changing because the system is failing to deliver economically and politically, leading to the rise of populists and self-defeating political movements. Brexit, the election of Donald Trump as president and the rise of rentier capitalism are all bad for democratic societies and the institutions upon which they rely, he writes. And that has worrying consequences for free societies and the businesses that operate within them.

The case is personal for Wolf. He is an economist and his parents were refugees from the Nazis, who were able to gain power partly because of the Great Depression. History, he says, is a warning that political mistakes can be hugely destructive when combined with economic disasters.

A podcast that profiles the drama of big deals

“The Closer”

Reporting about deals often centers the numbers. That approach can miss the drama behind them and the effect afterward. “The Closer,” a podcast hosted by the journalist Aimee Keane, unfolds rich stories behind the headlines, often revealing unexpected consequences.

In its first episode, it explored the 2013 merger between American Airlines and US Airways, which created the world’s largest airline, and the role that labor unions played in the deal. Since then, the podcast has explained how an action from the Department of Justice led to Modelo’s rise to become the top beer in the U.S.; why a failed deal in 2018 led to WeWork’s bankruptcy this year; and how private equity investors and Walmart killed Toys “R” Us (an episode that features DealBook’s Lauren Hirsch, who broke the story that the company was considering bankruptcy).

The show’s trick is showing the continuing relevance of old deals, and how the cascading events they unleash can reshape industries.

A podcast for true deal nerds

“Acquired”

The tech investors Ben Gilbert and David Rosenthal take listeners behind the scenes of some of the world’s most famous companies: Costco, LVMH, Porsche. Their extensively researched episodes run several hours long (one on Nike was about four hours) and explain the strategies and strange turns of fortune that allowed the founders of these companies to build enduring businesses. Gilbert and Rosenthal devote some episodes to guests, including the Nvidia chief executive Jensen Huang and the Berkshire Hathaway executive Charles Munger, who was interviewed about a month before his passing in late November.